Affirma for Financials

Gains from your Data Management Investments

Commercial Banks, Investment Banks, Credit Providers, Investment Funds and Insurance Providers have been subject to rapid technical and social developments over the past few decades. The building blocks of these organizations are changing on a continuous basis supported by transactional data integration. In addition, traditional physical channels are having to be balanced with evolving digital ones.

Affirma empowers organizations to ingest, manage, and generate diverse metadata throughout the data lifecycle, ensuring data remains accurate, accessible, and ready to drive informed decision-making.

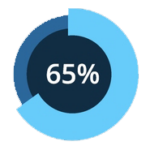

Bank executives agree that GenAI is part of their long-term vision for driving innovation and relevance.1

Bank executives agree that GenAI is part of their long-term vision for driving innovation and relevance.1

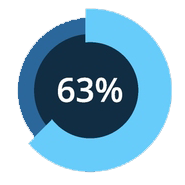

Bank executives state that data quality is a top challenge for analytics and utilization of innovative data sources in credit management.2

Bank executives state that data quality is a top challenge for analytics and utilization of innovative data sources in credit management.2Regulatory Compliance

Few industries are required to manage as many systems and integrations as financial services at such high standards (i.e., FIB-DM, BIAN), and the trend is towards ever more such integrations to satisfy demands from regulators and customers.

To reduce complexities and uncertainty around compliance and reporting it is essential to have access to metadata such as tracking history, movement and ownership of goods, services, or digital assets through data. Establishing provenance metadata decreases reporting efforts and improves quality by documenting transactions and changes to financial data.

Financial Analytics

Institutions can begin to offer innovative solutions, by leveraging technological advancements and by integrating emerging technologies like AI, machine learning and blockchain into traditional financial systems. Through financial analytics trends can be predicted across portfolio segments. A desire for personalized services is driving the need to manage the data for analytics.

By defining your metadata based on input from financial management, operations, and strategy, you can understand and describe how data works and relates. It reduces uncertainty when exchanging or reusing information and allows for trusted data-driven decisions.

Globalization

Integration of financial markets across international borders facilitates the flow of capital and financial services on a global scale. It leads to a dynamic but also a more challenging landscape as global capital flow can stimulate economic growth, development, and international collaboration.

Operating in different social, legal, and economic environments demands complex integrations of systems in a constantly changing environment. It is imperative that metadata for all aspects of the data lifecycle is coordinated and connected. This then will support productivity, innovation, and global economic growth.

WHICH INVESTMENTS ARE BEING PRIORITIZED?

Resent survey regarding bank investment priorities with US bank executives. Future-proofing banking: The enterprise transformation imperative

Affirma Capabilities

Connecting your Ecosystem of Data and Technology Investments

|

|

Benefiting From Your Metadata

Suddenly you and your organization are tasked to transform your electricity system into one that is cleaner, more resilient, and more affordable. And it that was not enough, it needs to happen in collaboration with other industry sectors, such as transportation,...

read more

Unleashing the power of the six data nodes

In everyday life we are generating huge amounts of data which we are increasingly attempting to use for improved and innovative outcomes to meet corporate objectives. It is therefore necessary to think about managing our data efficiently to ensure it is accurate,...

read more

Changing Your Data Management Reality

The reality we face today is an exponential growth of data with the potential to drive operational efficiencies and innovation. But this deluge of data needs to be managed, in a structured way, through processes, frameworks, practices and ideally driven by technology...

read more